翻屏组件设置面板

容器ID名称:#c_grid-1672129987525

关闭翻屏分辨率:768

组件说明:

每一屏的内容请使用模块进行制作,并将模块放置于栅格容器内,此翻屏组件,仅需设置好栅格容器ID及尾屏ID即可实现自动识别翻屏内容。

尾屏高度将自动识别,实现半屏翻动效果,无需设置其他内容。

名词说明:

容器ID:翻屏内容所在的栅格容器ID。

尾屏ID:最后一个不满全屏的模块ID。设置后将自动识别,并实现半屏翻动效果。

关闭翻屏分辨率:当小于某个分辨率宽度时,翻屏效果失效,改为滑屏效果。

另请注意:

本组件内容请勿做修改删除,以免影响效果。本组件在制作器内可见。在网页预览页面将不可见。

如你对本组件的使用已经熟悉,或已制作完成,请将此翻屏组件说明富文本元素删除。

澳门人威尼斯4399

专业从事电阻焊控制器、变压器、精密焊接、激光电源和非标激光工作站产品研发、制造、销售和工程服务的高新技术企业,已经有三十多年的历史和经验,形成了提供电阻焊电源及相关工艺为核心竞争力的业务体系。全心全意为客户提供最优焊接工艺解决方案,与价值链上合作伙伴l益共享是我们技术创新和制造精品的原动力。

20000

+

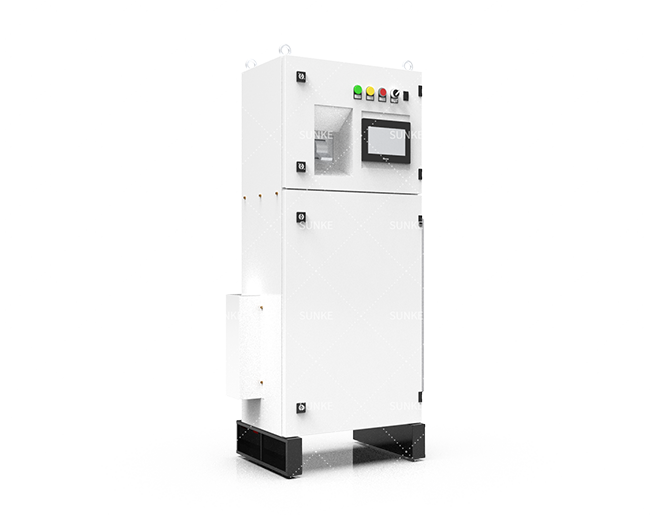

公司具有一流的SMT工艺设备、自动化装配生产线

生产各型号电阻焊控制器、变压器、精密焊接、激光电源和非标激光工作站产品

具备完善的质量保证体系,严格执行过程控制和程序控制

成功案例

全心全意地为客户提供最优解决方案,与价值链上合作伙伴利益共享是我们技术创新 和制造精品的原动力。